- This year, National College Decision Day is May 1.

- When weighing the options, families should tap online tools, strategically maximize aid offers and carefully consider loan choices to come up with a plan that covers all four years of college, experts say.

Watch 온라인카지노사이트 5 free wherever you are

is a major decision, but figuring out how to pay for it is an even bigger commitment.

And with just a few days before National College Decision Day on May 1, many families are struggling to come to terms with both finding the "right-fit" school as well as wrestling with the sky-high cost and looming balances. And all this while opportunities for are dwindling.

Get top local stories delivered to you every morning with 온라인카지노사이트 DFW's News Headlines newsletter.

"Choosing a school is a personal and individual decision," said Chris Ebeling, head of student lending at Citizens Financial Group.

Academics, extracurriculars, campus culture and career services are key considerations, he said, but "it's not just about the and the academics and setting you up for the right career trajectory, it's also about the cost — that is a real issue."

To that end, experts share their best advice on how to frame your decision before choosing a school, including coming up with a plan for how to pay for it and factoring in financial aid.

Money Report

Determine the net price of college

For starters, "no one should be committing to a school until they know that net price," Ebeling said.

The is the total cost of attendance, including tuition and fees, minus grants, scholarships and education tax benefits, according to the College Board.

Even though the price tag for a has never been higher, nearly 75% of all undergraduates receive some type of financial aid, according to the , which can bring the cost significantly down.

More from Personal Finance:

Most colleges have a on their websites to help students determine their out-of-pocket expenses. However, "some are better than others," Ebeling said.

He recommends other online resources to get an even more accurate picture, such as or the College Board's.

"A good net price calculator would be within a few thousand dollars," Ebeling said.

The net price can also vary greatly between schools.

"At Harvard, for example, the sticker price is very high, but the ," Ebeling said.

Or, Ebeling added that "you could look at a state school where the sticker price is lower but they provide less assistance and the net price is higher."

In fact, when it comes to offering financial assistance, private schools typically have more money to spend, other experts also say, and some are increasingly .

Factor in financial aid

For a majority of students and their families, is the in their decisions about choosing where to attend and how to pay the tab. But not all financial aid is equal either.

The amount of aid offered matters, as does the breakdown between grants, scholarships, work-study and .

Once students fill out the Free Application for Federal Student Aid, which serves as the gateway to all federal money, they will receive their award letters.

In most packages, there are several financial aid options. The goal is to maximize gift aid — money that doesn't need to be paid back, such as scholarships, fellowships and grants — and minimize loans that will need to be repaid with interest.

"There is a hierarchy of sources of funding," Ebeling said. "The first, and most obvious, is the free money."

But even with gift aid, it's important to read the fine print, such as whether a grant is renewable for all four years or whether a minimum grade point average must be maintained. It's worth noting that if a student fails to meet the terms, such as a grade point average requirement, they may have to repay some or all of a grant or scholarship.

Look for additional scholarship dollars

Beyond the college aid offer, there are still alternative sources for out there, according to Matt Lattman, a senior vice president at Discover.

"There are many different scholarships that can be based on talents and interests, membership in professional or social organizations, or even luck of the draw," Lattman said. Some scholarships are annual, others per semester, and some even provide a monthly opportunity to earn money towards your education, he added.

Students can ask their high school counselor about opportunities or search websites such as or the .

Make a financial plan for all four years

Ebeling recommends coming up with a proactive plan to cover the entire four years of college from the outset. "You have to think about this in aggregate," he said.

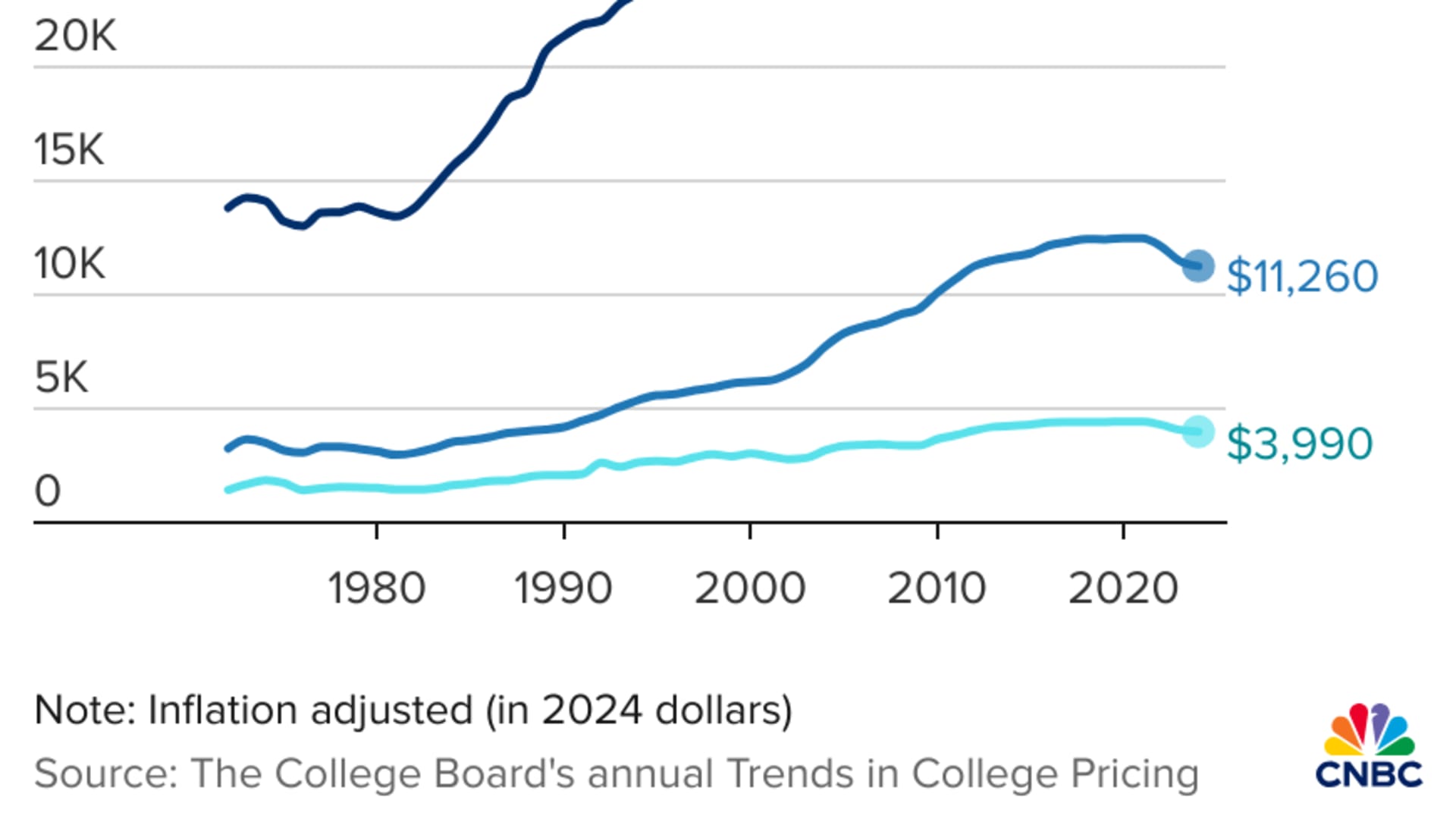

Considering that tuition adjustments average roughly , if you know you are going to need to borrow, start with federal direct subsidized and unsubsidized loans, he said. "Generally those are the best loans out there."

Still, it's also never too late to fund a , which comes with added tax benefits and .

Plus, — and for grandparents, there is also a new "," which allows them to pad a grandchild's college fund without impacting their financial aid eligibility.

Most importantly, "every dollar saved is a dollar less you have to borrow later," said Smitha Walling, head of Vanguard's education savings group.